|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

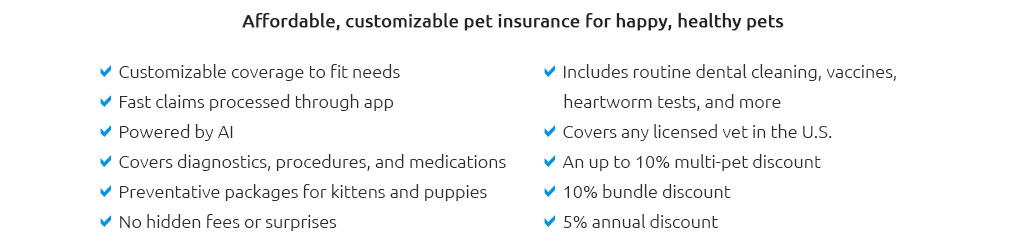

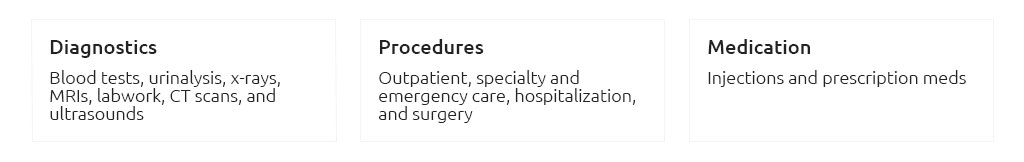

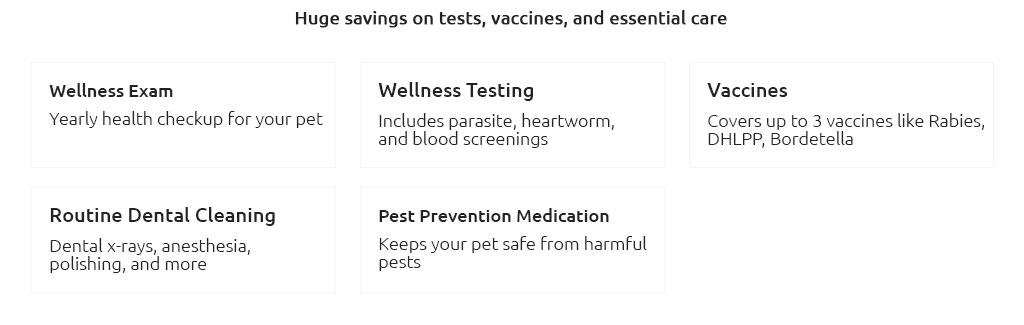

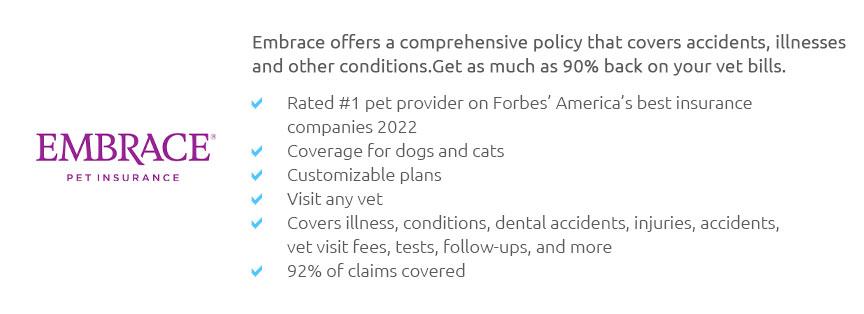

Health Insurance for Pets in Vermont: Navigating the Path to Furry Well-beingWhen it comes to safeguarding our beloved companions, health insurance for pets in Vermont emerges as a crucial consideration for many devoted pet owners. With the Green Mountain State's unique blend of natural beauty and a commitment to well-being, it's no surprise that pet parents here are particularly attuned to the nuances of ensuring their pets' health and happiness. However, as with any form of insurance, there are common pitfalls and subtle challenges that can complicate the decision-making process. Firstly, it's imperative to recognize the variety of plans available. Much like human health insurance, pet policies can vary significantly in coverage, cost, and restrictions. One of the initial steps is understanding what each plan covers. Does the policy include wellness visits, vaccinations, or emergency care? Many pet owners make the mistake of assuming all-inclusive coverage, only to discover gaps when they need it most. Thus, scrutinizing the fine print and asking pertinent questions is an invaluable strategy to avoid unwelcome surprises. Another often overlooked aspect is the importance of timing. Enrolling in a policy while your pet is still young and healthy is generally advisable. Pre-existing conditions are typically not covered, and waiting until a health issue arises can lead to limited options and higher premiums. This is a common oversight, and starting early can lead to significant long-term savings and peace of mind. In Vermont, where outdoor adventures are a way of life, accidents and injuries can occur more frequently than anticipated. Pet insurance that covers accidents and injuries is particularly beneficial, especially for those adventurous pets that accompany their owners on hikes and other outdoor activities. It's wise to consider policies that specifically cater to these eventualities, ensuring that your pet can continue to enjoy the great outdoors safely. Moreover, cost is a significant factor. While it may be tempting to choose the cheapest option, this can be a false economy. Low-cost plans might offer minimal coverage, leading to substantial out-of-pocket expenses in the event of a serious health issue. Balancing cost with comprehensive coverage is a nuanced decision that requires careful evaluation of your pet's specific needs and lifestyle. As we delve into the realm of pet insurance, it's also worth mentioning the role of the veterinarian. Establishing a relationship with a trusted local veterinarian can provide invaluable insights into the most suitable insurance options based on your pet's breed, age, and health history. Their expertise can guide you in selecting a policy that aligns with your pet's unique health profile. Frequently Asked Questions

In conclusion, securing health insurance for your pet in Vermont requires a thoughtful approach, balancing coverage needs with financial considerations and the unique lifestyle that this picturesque state offers. By avoiding common mistakes and making informed decisions, you can ensure your furry friend enjoys a healthy and happy life, free from the burden of unforeseen medical expenses. https://spotpet.com/locations/vermont

The average pet insurance claims cost in Vermont is $398.13. This number comes from internal claims data and reflects just how expensive vet care can be in the ... https://www.pawlicy.com/pet-insurance-usa/vt/

No, in Vermont you do not legally have to get pet health insurance for your dog (or cat). It's an optional tool to protect against unexpected veterinary costs - ... https://www.fetchpet.com/locations/vt-pet-insurance

The average monthly dog premium in VT US is $34. The most common limit is $10,000, The most common deductible is $300, and the most common copay is 80%; The ...

|